What’s the Most Tax Efficient Director’s Salary in 2022/23?

As a director you’re legally separate from your limited company, even if you’re also the owner. This means that you’re not allowed to simply keep the profits for yourself in the same way that a sole trader can.

Instead, you’ll need to decide how much to pay yourself. The most tax-efficient way to take an income from your own limited company is normally through a combination of a low salary (in the same way an any other employee) and dividend payments.

Why should I pay myself a director’s salary as well as dividends?

As a director, you’re technically an employee of your own limited company. Employers and employees both pay National Insurance Contributions (NICs) on salary payments, but not on dividends, so it makes sense to pay yourself a smaller salary and make up for it with dividend payments.

But the good thing about taking a salary is that is means you have regular income throughout the year which, because directors are ‘office holders’, can be below minimum wage without breaking any rules.

So how much should you pay yourself from your own company? Paying yourself as a company director is actually a bit of a balancing act in order to be as tax efficient as possible.

To get the balance right you’ll need to consider National Insurance contributions as an employee and employer, how many people there are in the business, tax allowances for dividends and for income, tax relief for employee salaries, and even the benefits of making qualifying payments for the State Pension.

Sit tight, and we’ll talk you through director’s salaries, and what the optimum amount to pay yourself is. We know it can be confusing, so get an instant quote online if you need more help!

National Insurance and director’s salaries

The thresholds for employer’s and employee’s NI are different, so this has an impact on the amount of salary that you take. If you take a salary from the business and it’s higher than the National Insurance threshold (the point at which you start paying National Insurance) for both employer and employee NI:

- Your company, as your employer, has to pay employer’s National Insurance Contributions.

- You, as the employee, pay National Insurance on the salary that your company pays you.

It basically means you’re paying National Insurance twice on the same money – which isn’t very tax efficient at all!

The 2022/23 NI thresholds for employers and employees are shown in our table below. The threshold for employers is actually lower, so they start paying NI sooner than employees.

If you need to refer to the figures for 2021/22, you can view them in our tax rates article.

2022/23 Employer and employee National Insurance thresholds

|

Weekly NI Threshold |

Monthly NI Threshold |

Annual NI Threshold |

| Lower Earnings Limit (LEL): Employees who earn below the limit don’t incur NI, but they also don’t accrue NI benefits, such as qualifying payments towards the State Pension. |

£123 |

£533 |

£6,396 |

| Primary Threshold: This is the point at which employees start paying NI. Any earnings below this point but above the Lower Earnings Limit still don’t incur NI, but employees will earn NI ‘credits’, and accrue NI benefits.

In 2022/23 the National Insurance Primary Threshold will increase during the tax year. |

|

|

|

| 6th April – 5th July 2022 |

£190 |

£823 |

£9,880 |

| 6th July 2022 onwards |

£242 |

£1,047.50 |

£12,570 |

| Secondary Threshold: Employers make National Insurance Contributions on salary payments above this threshold. |

£175 |

£758 |

£9,100 |

Qualifying for the State Pension

Taking a salary which is higher than the Lower Earnings Limit (£6,396 per year in 2022/23) allows directors to build up qualifying years for their State Pension.

If your salary is above the LEL but below the Primary Threshold (£9,880) then you’ll accrue all the benefits of NI, without actually paying it. This will affect how much State Pension you are entitled to once you pass state retirement age.

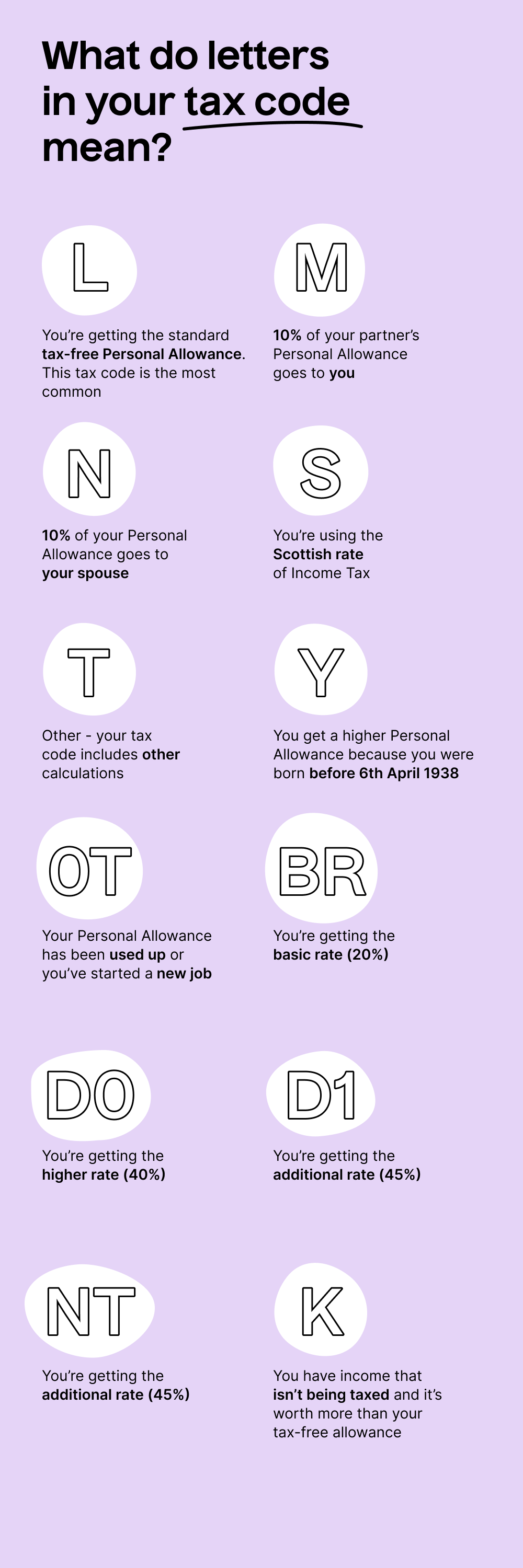

Using the tax-free Personal Allowance on your director’s salary

Your Personal Allowance is the amount you are allowed to earn before you have to start paying income tax.

In 2022/23, the Personal Allowance is £12,570.

You only pay tax on the part of your income that is above the Personal Allowance threshold. For instance, if you earn £14,000 in a year, you’ll only pay income tax on £1,430 of it.

£14,000 (salary) – £12,570 (tax free Personal Allowance) = £1,430. The amount subject to income tax is £1,430.

If you take a salary from your limited company which is below the Primary Threshold for National Insurance (£9,880) you won’t pay tax or NI on it.

Paying tax on dividends

It’s worth noting that although they’re not subject to NI, dividends are subject to tax, but at a different rate to normal income tax. The good news is that there is also a separate dividend tax allowance that you can use on top of the Personal Allowance.

In 2022/23, the Dividend Allowance is £2,000.

Salaries are an allowable expense for Corporation Tax

A limited company pays Corporation Tax on the profit that it makes throughout the year. Claiming tax relief on allowable expenses reduces the amount of profit, therefore reducing the amount of Corporation Tax which the company pays.

Salaries are an allowable expense, so if you’re a company director then paying yourself a salary from the business can help you lower your corporation tax bill.

How does the NI Employment Allowance affect director’s pay?

Thanks to the Employment Allowance, the optimum salary for a company director also depends on how many other people there are in the business.

In 2022/23 eligible employers can use the Employment Allowance to claim up to £5,000 in order to cover the costs of employer’s National Insurance.

To be eligible, employers must have at least 1 employee, or 2 directors, on the payroll, and the directors must not have another company that is claiming the Employment Allowance already. This means that sole directors can’t claim the allowance, which is why the optimum salary is a bit different for them.

2022/23 Director’s salaries – How much should I pay myself from my limited company?

Considering all the taxes and allowances together, the most tax-efficient salary for a limited company director depends on whether they’re a sole director, or there are more people in the business.

- The optimum salary for a sole director in 2022/23 is £9,100.

- The best salary if there are two or more directors is £11,908.

What is the best company salary for sole directors in 2022/23?

The most efficient salary for sole directors in 2022/23 is

£758.33 per month.

If you’re the sole director and pay yourself a salary through your own limited company, the best amount to pay yourself is £9,100 per annum (or £758.33 a month). This is because:

- It’s at the secondary threshold so your company won’t need to pay employer’s NI on it.

- This salary is lower than the primary threshold, so you won’t need to pay employee’s NI.

- It’s above the Lower Earnings Limit, so you will still earn NI credits, which is great news for your state pension.

- This is less than the tax-free Personal Allowance threshold.

- A sole director cannot claim the Employment Allowance.

What is the most tax efficient salary for two or more directors in 2022/23?

Having 2 or more directors on the company payroll means that you’re eligible to claim the Employment Allowance. In 2022/23 the primary threshold will increase mid-year.

This means that the point at which you start paying employee’s NI will be £9,880 until July 2022, when the threshold increases to £12,570. Over the year, the optimum salary in a company with two or more directors is £11,908

The most efficient salary for 2 or more directors in 2022/23 is

£11,908.

This is because two or more directors can take an annual salary up to the primary threshold without needing to pay employee’s NI, and then claim the £5,000 Employment Allowance to cover the portion of employer’s NI they would otherwise incur.

What if I have another source of income?

The optimum amount for director’s payroll takes advantage of the Personal Allowance (£12,570), but if you are already using it up because you have other income from elsewhere, then director’s payroll becomes PAYE payroll, and subject to tax and NI as normal.